Investment

Investing should be easy – just buy low and sell high – but most of us have trouble following that simple advice. There are principles and strategies that may enable you to put together an investment portfolio that reflects your risk tolerance, time horizon, and goals. Understanding these principles and strategies can help you avoid some of the pitfalls that snare some investors.

Should You Invest in Exchange Traded Funds?

There are thousands of ETFs available. Should you invest in them?

Have A Question About This Topic?

Behavioral Finance

An amusing and whimsical look at behavioral finance best practices for investors.

BairdNext Insights: What is Different About This Bear Market

Worried about what a bear market might look for you? Here are a few financial points to consider.

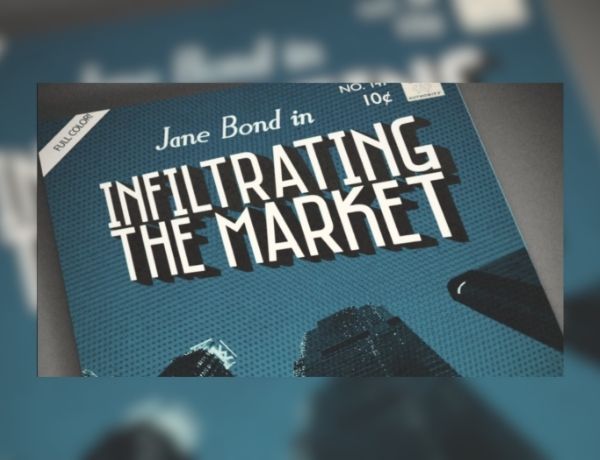

Jane Bond: Infiltrating the Market

Agent Jane Bond is on the case, cracking the code on bonds.

Bank Failures Spark Questions Over Deposit Insurance

Our Washington Policy Research team explores the debate in Washington about whether to expand federal deposit insurance.

Earnings for All Seasons

Earnings season can move markets. What is it and why is it important?

Wealth Management Mailbag: Spring 2022

In this issue of the Wealth Management Mailbag, our wealth experts answer clients’ questions on inflation and cryptocurrency.

The Difficulty in Calling a Market Top

Trying to “time the market” is both highly risky and incredibly difficult.

The Benefits of Consolidating Accounts

Keeping your accounts in one place isn’t just convenient – there are many advantages to doing so.

Planning Moves for Volatile Times

Worried about how volatility in the markets and economy will affect your finances? Here’s a few ways to protect your assets.

View all articles

Are Alternative Investments Right for You?

With alternative investments, it’s critical to sort through the complexity.

Global and International Funds

Investors seeking world investments can choose between global and international funds. What's the difference?

Behavioral Finance

An amusing and whimsical look at behavioral finance best practices for investors.

16 Wall Street Cliches in 60 Seconds

Pundits say a lot of things about the markets. Let's see if you can keep up.

The Rule of 72

Do you know how long it may take for your investments to double in value? The Rule of 72 is a quick way to figure it out.

Investments

You’ve made investments your whole life. Work with us to help make the most of them.

View all videos

-

Articles

-

Videos